Assessment by Moody’s, S&P or Fitch and the need for in-depth analysis of the Balkan economies

In the latest assessments by Moody’s, S&P or Fitch, it seems that three Balkan economies already have an increasing ranking, being upgraded to the Ba3 level. Meanwhile, three other countries are still rated lower at BB- and B+ levels.

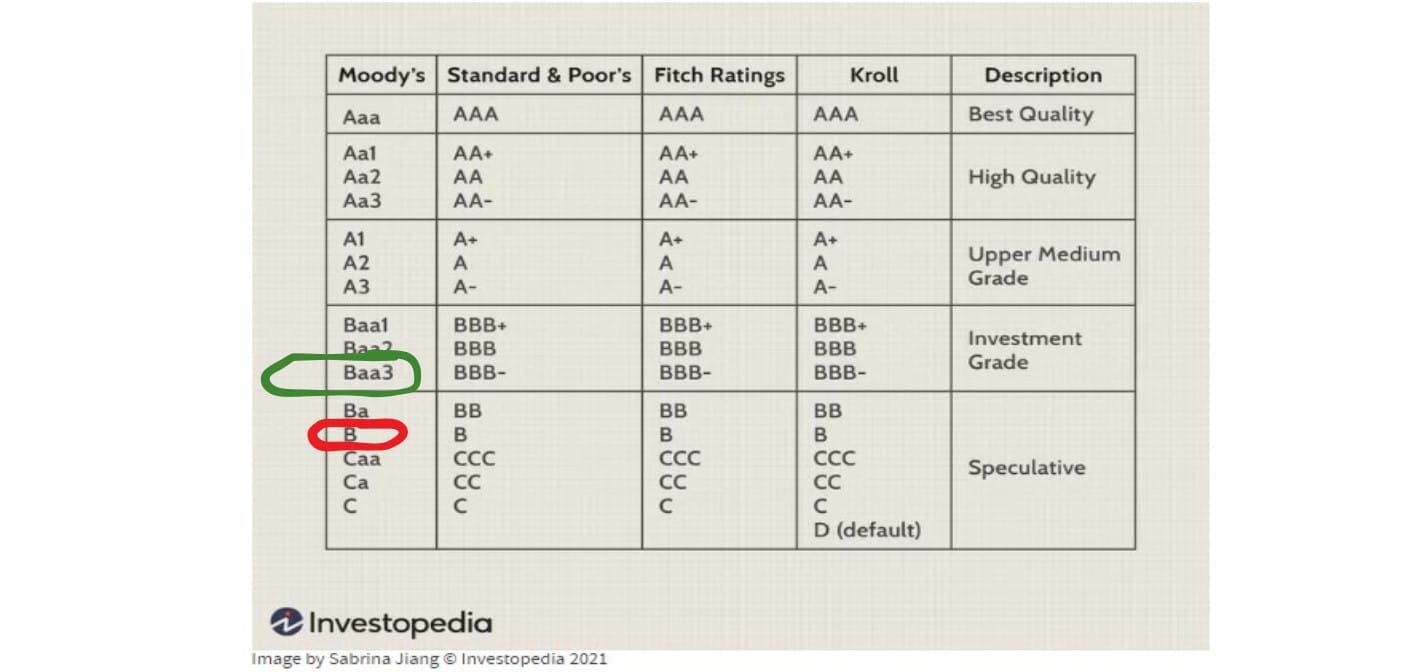

These assessments and rankings, which show the creditworthiness of the public finances of countries in relation to their financial obligations, already hold a position, where it seems that the category of countries with Ba3 or above (Ba2) are among the countries with the highest reliability for foreign investors showing with this assessment that the countries are reliable for investment and they can be credited with additional foreign capital.

Meanwhile, for the three countries that do not have this assessment, they do not have the same reliability to be financed and to attract foreign capital investments with a strong certainty of investment return.

| Ratings Moody’s, S&P and Fitch, 2024 | |||

| Western Balkans | Moody’s | S&P | Fitch |

| Serbia | Ba2 | BB+ | BB+ |

| Bosnia – Herzegovina | B3 | B+ | |

| North Macedonia | BB- | BB+ | |

| Montenegro | Ba3 | B+ | |

| Albania | Ba3 | BB- | |

| Kosovo | BB- | ||

From the ratings held by credit rating organizations[1], Serbia is the country with the latest highest rating with Ba2, while Montenegro and Albania hold a Ba3 rating with an increase from B1 they held a few months ago.

North Macedonia and Bosnia-Herzegovina have ratings (B+) with relatively low confidence to be credited by foreign capital, and so does Kosovo (BB-), which does not yet seem to qualify for a level of reliability beyond the threshold of doubt. if the invested capitals can be recovered with a guarantee (the ranking scale is in the illustration at the top of the analysis).

These are the explanations that clarify the meaning of the assessments by credit risk assessment agencies of the Balkan countries.

But why do these paying countries need to have this credit health analysis?

Moody’s, S&P, Fitch Ratings are credit rating agencies that rank the creditworthiness of borrowers by evaluating their debt using a standardized rating scale.

This assessment of the agencies serves as the most reliable justification for countries to take on new debt, as well as to stimulate the interest of foreign capitals to look at these countries with a guaranteed interest in reinvestment.

In the economic reality of the countries, however, there are fiscal and financial spaces that do not fully coincide with these assessments, or even the model used for the classification of rankings[2].

First, the reason to show how sustainable these estimates are starts with the macroeconomic data of the countries, accepting only the fact of economic growth and not of long-term sustainability.

From the economic assessment data (quarter II 2024) of the candidate countries for the EU[3] it can be seen that the data of economic growth, balance of payments, budget deficit, public debt and unemployment and inflation, for countries that maintain a level rating Ba2 and Ba3 these indicators are not higher in relation to government debt, economic growth, budget deficit and economic growth than the Balkan countries with a credit risk rating of BB- and B+.

If we look at the analysis in relation to the level of economic growth of the Balkan countries, it can be seen again that the growth trend that shows the stability of the economies does not coincide with the evaluation of the organizations. This can be seen for Albania and Montenegro in the decline in growth rates, and the trend for Serbia is different. So, in the economic assessment, it can be seen that only Serbia justifies the assessment of stability, while all other countries have downward trends or stagnation of economic growth rates.

| Economic growth (y/y in %) | 2021 | 2022 | 2023 | 2024 |

| Albania | 8.9 | 4.9 | 3.4 | 3.3 |

| Kosovo | 10.7 | 4.3 | 3.3 | 3.8 |

| Montenegro | 13 | 6.4 | 6.3 | 3.4 |

| North Macedonia | 4.5 | 2.2 | 1 | 1.8 |

| Bosnia-Herzegovina | 7.4 | 4.2 | 1.7 | 2.8 |

| Serbi | 7.7 | 2.5 | 2.5 | 3.8 |

| Fiscal deficit (% GDP) | 2021 | 2022 | 2023 | 2024 |

| Serbia | -4.1 | -3 | -2.2 | -2.2 |

| Bosnia-Herzegovina | -0.3 | 0.5 | -0.9 | -1.7 |

| North Macedonia | -5.3 | -4.5 | -4.7 | -4.9 |

| Montenegro | -2.1 | -4.9 | 0.6 | -2.8 |

| Albania | -4.6 | -3.7 | -1.3 | -2.3 |

| Kosovo | -1.3 | -0.5 | -0.3 | -1.1 |

| Public Debts (% GDP) | 2021 | 2022 | 2023 | 2024 |

| Serbia | 54.5 | 53 | 49.7 | 49.6 |

| Bosnia-Herzegovina | 33.9 | 29.3 | 26.9 | 27.4 |

| North Macedonia | 51.4 | 50.4 | 54.1 | 56.3 |

| Montenegro | 84 | 69.2 | 59.3 | 62.2 |

| Albania | 71.5 | 62.1 | 57.2 | 55.4 |

| Kosovo | 21.1 | 19.7 | 17.2 | 17.2 |

| Current account (% GDP) | 2021 | 2022 | 2023 | 2024 |

| Serbia | -4.3 | -6.9 | -2.6 | -4.1 |

| Bosnia-Herzegovina | -1.8 | -4.3 | -2.8 | -3.2 |

| North Macedonia | -2.8 | -6.1 | 0.7 | -1.8 |

| Montenegro | -9.2 | -12.9 | -11.4 | -12.6 |

| Albania | -7.7 | -5.9 | -0.9 | -3.9 |

| Kosovo | -8.7 | -10.3 | -7.6 | -8.1 |

But even the data on the budget deficit, on the public debt and the balance of payments are seen to again not coincide with the assessments that present a low credit risk and security for investors.

Of course, in this analysis, other data should be considered in order to understand even more clearly how we should look at the evaluation of the organizations for the Balkan countries.

In this sense, we pose the question:

- If these indicators are not at that level to necessarily justify the assessments carried out at the request of the countries, then what can be further in the references that have been used as arguments by credit risk assessment organizations?

As far as the level of corruption is concerned, in the Balkan countries it can be seen that Albania, followed by Bosnia and North Macedonia, are perceived as countries with high public sector corruption. Meanwhile, it seems that this perception of the citizens could not indirectly affect the assessment of the sustainability of the economies of these countries, as well as the state’s balance sheet. In fact, corruption is a high risk for all investors and foreign capitals and is an important element in the assessment of investment and economic risks.

This element has been de facto appreciated by investors, if we start from the weight of incoming foreign investments in the Balkan countries[4]. From the indicators of foreign investments in relation to the GDP of each country, a downward trend or stagnation can be seen, except for Serbia, which recorded an increase of over 1 decade.

Although Albania has an increase in foreign investments in absolute value, their weight on average is 7% of GDP in the last 5 years. The trend of foreign investments in relation to GDP from 2013 (as much as 9.7% of GDP) until 2023 has been decreasing (as much as 6.7% of GDP).

| Net Foreign Direct Investment Flow, 2013-2023 | m. Euro | ||||||||||

| FDI/Years | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| FDI values | 945 | 869 | 890 | 942 | 899 | 1,022 | 1,079 | 933 | 1,031 | 1,372 | 1,499 |

| Share to GDP | 9.7% | 8.6% | 8.5% | 8.7% | 7.7% | 7.7% | 7.8% | 7.0% | 6.7% | 7.3% | 6.7% |

| Source: BoA, INSTAT, IMF, WB, MoF | |||||||||||

In the light of comparing macroeconomic and fiscal and financial data with what is presented to us as an assessment by organizations that use advanced methodologies and algorithms to reach their conclusions, it seems that they do not take much into consideration the pace of new developments, such as and the internal indicators they use for their calculations (eg the structure of the economy, the risk of an unrealistic indicator of public debt from conversions in foreign currencies, etc.).

When the data and experts in the field are out of sync with each other and the data used for calculations, there is a risk of losing responsibility by superficially trusting each other’s work.

For example, Moody’s ended up overturning the results of its credit rating model because credit rating analysts did not try to understand why the model might generate results that did not match their intuitions.

Building the model in line with the data enables experts in these organizations to have an intuitive understanding of how the algorithmic model works. Such common ground can enable organizations to create and use models that better adapt to changes in the economic and political environments of countries with little international weight, such as those that form part of the Western Balkans.

[1] Moody’s, S&P or Fitch ratings are forward-looking opinions on the relative credit risks of financial obligations issued by non-financial corporations, financial institutions, structured financial instruments, project financing instruments, or public sector entities (state budget).

[2] https://ratings.moodys.com/api/rmc-documents/395819

[3] https://economy-finance.ec.europa.eu/document/download/1ecf4ef2-5030-44a6-9d74-d38a8b022604_en?filename=tp073_en.pdf, page 8 and pages 11, 15, 19, 23, 27, 35.

[4] https://wiiw.ac.at/transforming-the-western-balkans-through-near-shoring-and-decarbonisation-dlp-6999.pdf, page 19

Leave a Reply

You must be logged in to post a comment.