Why in Albania we have more expensive fuel than others?

In the financial reasoning of the price of fuel in Albania are given sufficient arguments to leave room only for a summary and updating them with the situation after the start of Russian aggression and the imposition of sanctions from world against their economy.

Fuels in Albania are the most expensive in the region for at least the last 20 years, when taxes were lower than now and the market was more unstructured.

The main influential political elements and factors are listed as follows:

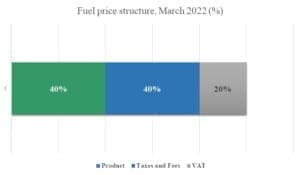

1.Central and local taxes, as well as tariffs are unequivocally the main, controlling and influential element of the final price with at least 60% of it. While over the last decade there have been anti-informality measures to narrow the scope of abuse of budget obligations, from the time of the Nano government (last), Berisha 1, Berisha 2 began to be included in the price and taxes previously paid on the vehicle or not were at the final price.

Meanwhile, other taxes remained as they were until modified and adjusted in2022, when the excise tax will no longer be only 37 lek / liter, but will also be indexed according to the level of inflation.

Environmental (carbon) taxes and circulation taxes are fixed values and are not affected by the market. They have a share at least of 15% of the current retail price[1]

For every 10 ALL product price increase, its weight falls by 0.6% in the final price structure. For every 10 lek product price reduction, its weight increases by 0.9% in the final price structure

Excise until 2022 has been fixed as a value to the price and was not affected by the market. But when in the fiscal package of 2022 it was intended to index excise according to inflation, then the value of excise is influential according to inflation and proportionally increases its share according to the level of inflation growth. Given the inflation trends announced by the world market at the end of 2021, this fiscal policy can be considered wrong and has an impact on the economy and consumption. But this policy seems to have been undertaken to supplement the tax exemptions from small business and other exemptions and facilities, without properly analyzing the market and the requirements of the businesses, which have continuously requested to review the price structure for the part of taxes as well as evasion, as an integral part of the fuel market. However, if we look at its weight in the current reference price (203 ALL / liter) it seems to hold a share of 18% of the final price, not including the indexation percentage. If included, then the share increases by at least another 3% for 2022 on an annual basis of inflation (“inflation tax”).

For every 10 lek increase in product price, its weight falls by 0.7% in the final price structure. For every 10 lek product price reduction, its weight increases by 1.1% in the final price structure.

VAT has a share of 20% of the final price and it is not affected by the fuel market prices, but neither by the increase or decrease of the international price of the product, but is set as a consumption tax in the final of all components of the price[2].

Regulatory fees (which are part of the price paid by wholesale and retail companies, are related to direct non-tax budgetary burdens provided by the state[3], (as well as Concessions fees and Local Taxes (all together) occupy the share of last by share up to 4% of the current final price. Warning! Local taxes and institution fees have increased over the years

2.The increase in formalization of sector over the years in terms of turnover, but also employees and other income / expenses has affected the price increase by at least 5% in the last decade, as it has increased undeclared costs and forced wholesale and retail businesses to put in the final price.

3.Domestic production with the level of retail market share with 25-30% of it in the most productive years until near 2016 has amortized the final price of the product in the domestic market by diversifying with the import price, despite the fiscal abuses that time has shown in refining of fuel. Lack of production in the market has affected the increased price retention including costs covered by other items of operating expenses and final price rounding.

4.Unstable fiscal policy (Frequent fiscal packages) and insufficiently and properly analyzed, with fiscal administration without clear and consistent objectives to narrow evasion and with little impact on the formalization of the turnover chain have panicked the market ( anti-informality operations and short time campaigns) with consequent side effects that have influenced business decisions to increase the cost caused by market uncertainty and lack of fiscal stability. The political chronicle in the appointment of tax managers (with very few exceptions) and the harmful and prejudicial policy towards professional staff of fiscal administrations have affected the will to fight informality and evasion and have fostered corruption.

5.The “tax” of corruption, which seems to be more structured in recent years according to an analysis [4]we have done has affected over the years by at least 5% increase in prices not only of fuel, but also services and other products with which the fuels give and take.

6.The price of the oil exchange, or rather the cost of its purchase from international market according to the invoice that enters the customs impact enough the price share (currently holds a weight of 40 – 42% of the final price). But this basic cost element in determining the final price has been used by domestic companies to cover the still undiscovered areas of evasion to avoid liabilities and has exposed its impact on price, as an inelastic cost that does not reflect the price dynamics of scholarship.

The whole panorama of the structure of the constituent elements in the final price of fuel is an indicator that presents to explain why we have this high price level in relation to the surrounding countries, but also others further away.

All neighboring countries with Albania apply a price structure without of most of the taxes we include in this article, leaving effective only the excise and VAT, as well as certain tariffs with insignificant weight in the trade cost. On the other hand, the most effective sectoral policies related to:

- diversification of production of fuels and energy products (use of coal for industrial processes, effective use of biofuels, active and productive maintenance of oil refineries), as well as

- diversification of fuel consumption (use of fiscal facilities and financial incentives for imports and infrastructure within cities for the market of electric vehicles, restraint policy for old vehicles, use of liquefied petroleum gas (LPG),activation and use at lower costs transport of goods and passengers through rail and water system , stimulating the use of urban and intercity vehicles, such as: bicycles, wheelchairs, etc.)

have influenced these countries to reduce fuel costs by reducing market demand for them to an extent that reflects on the financial stability of the fuel market.

But also fiscal administration and anti-evasion policies in these countries have functioned more effectively than in Albania.

Studies conducted on the diversification of the market and sources of energy production reveal that performance is higher in economies with low diversity but closely related to the product chain supply and lower in economies with high diversity but unrelated to the product chain supply, suggesting that the diversification strategy does not fit the structure of the economy, but also consumption and consumers is detrimental to the performance of the economy and price elasticity.

The current sensitivity to high prices in Albania, which started in mid-2021, as well as 4 years ago, is related to the effect it has on the cost of living, which currently has an increase of at least 20% for the first quarter of 2022 for food products (including fuels) for vulnerable people. In the calculations performed by us analyzing these market price signals, we notice that for every 10 lek / liter price increase the net income of households decreases (depreciates) by an average of 5 percent from the domino effect in the market, with a similar impact in all income groups. Based on the average base price of 190 lek / liter at the beginning of March 2022, then the increase is on average 23 lek / liter, while the reduction of net income reaches 10%.

This means that with the fixing of the price of fuel 203 lek / liter, as well as the impact on other prices of products and services, the monthly income of 10,000 lek / month is currently depreciated by 1,000 new lek. A monthly income of 20,000 lek / month is depreciated with 2,000 new lek and an income of 30,000 lek / month is depreciated with 3,000 new lek. A family with 40,000 lek / month income has a depreciation of purchasing power (the value of the lek in the market) with 4,000 new lek.

Thus, the impact on the real value of the lek increases with the progression of income and also depends on how much goods and services are consumed[5].

[1] on 17.03.2022 the declared retail market price by the Fuel Supervision Board is 203 ALL / liter

[2] product cost, taxes and fees, operating expenses and depreciation, financial expenses

[3] Licensing / relicensing fee (https://infrastruktura.gov.al/wp-content/uploads/2017/10/VKM344date19042017.pdf); Deposit volume verification fee; Pumping station safety certification fee; Pump control fee; Marking concession (fuel targeting; import scanning concession on import

[4] https://altax.al/product/kostoja-e-korrupsionit-ne-ekonomi-dhe-ne-cmimet-e-mallrave-trajtimi-i-tij-nga-qeverisja-qendore-dhe-vendore-shoqeria-civile-dhe-biznesi-2022/

[5] see Household Budget Survey 2020, published by INSTAT

Leave a Reply

You must be logged in to post a comment.