What and How to Invest in 2026?

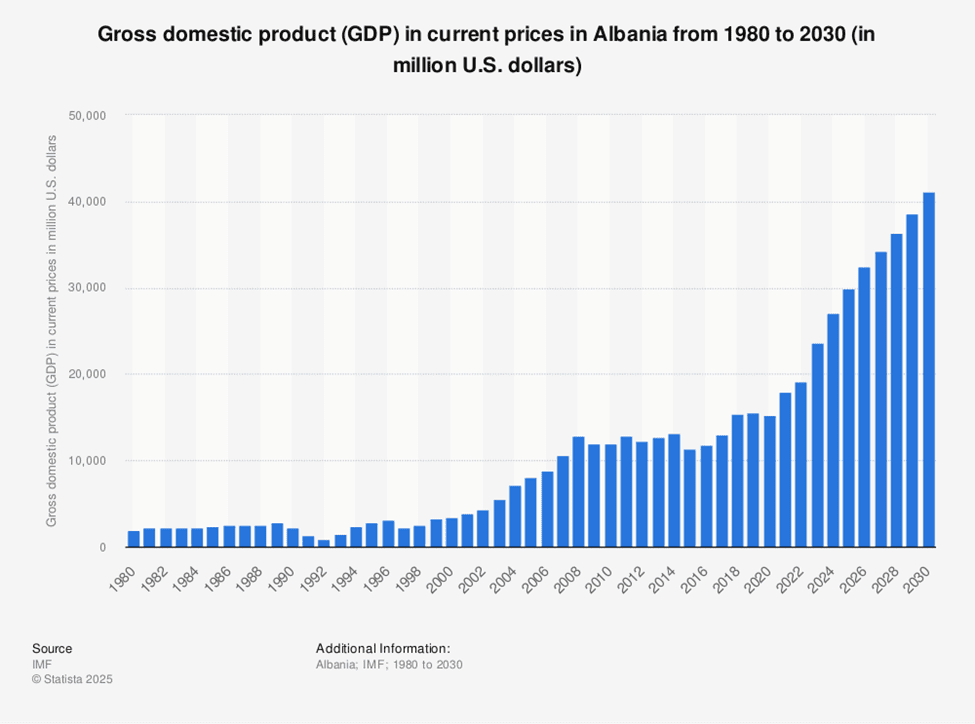

The structure of economic growth in Albania for 2026 is mainly based on domestic consumption and tourism, considering that exports remain limited and industrial production is relatively low. Domestic consumption benefits from wage growth and remittances from emigrants, while tourism continues to be a seasonal driver, especially in coastal and tourist areas, generating significant revenue with an expected record of 12.5 million visitors in 2025–2026. According to forecasts by the World Bank and IMF, GDP growth is expected to be around 3.5% in 2026, supported by tourism, construction, and private consumption, but with challenges such as low productivity in industry and agriculture.

Public investments remain high, mainly in road infrastructure, bridges, energy, and logistics projects, with plans for transport modernization in 2026, including highways and railways. This government strategy aims to increase economic capacities and create a more favorable environment for businesses, reducing transport barriers and improving energy efficiency.

Albania is positioning itself as a regional hub for diplomacy, energy, transport, and tourism, with 100% renewable energy production.

However, productivity in key sectors such as industry and agriculture remains low.

Automation in industry is limited, and the use of advanced technologies in agriculture is sporadic, which increases costs and reduces competitiveness in regional and international markets.

For this reason, smart investment is linked to existing cash chains and functioning sectors, not to areas without infrastructure or a developed market. Agriculture and forestry face challenges from climate change, with temperature increases up to +2°C by 2050, but adaptation plans offer opportunities.

Where does it make real sense to invest in Albania in 2026?

Priority sectors include renewable energy, real estate, tourism, agro-processing, and digital services, as highlighted by major investors such as Turkey, the Netherlands, and Italy.

| Sector | Risk Coefficient (KTR) | Cash-flow | Return Cycle | Seasonality | Operational Alerts |

| Solar energy & energy services | 4/10 | Stable | 6–9 years | Low | ⏳ delays in installation, unplanned costs |

| Functional real estate | 5/10 | Stable | 7–10 years | Low | ⏳ rental gaps >1 month |

| Supportive & quality tourism | 6/10 | Seasonal | 5–8 years | High | ⚠️ off-season periods |

| Agro-processing & food logistics | 5/10 | Controllable | 6–9 years | High | ⏳ post-harvest losses >10% |

| Exportable professional services | 3/10 | Stable | 2–4 years | Low | 💰 staff shortage or contract loss |

1. Solar energy & energy services

Albania has a lack of private energy capacity and prices are unstable. Businesses and the HORECA sector are moving toward self-production to reduce dependence on main suppliers. The most reasonable investments are solar plants, O&M services, and batteries & energy efficiency, with new projects such as the recently launched 150 MW initiatives. This sector has a KTR of 4/10, i.e., medium risk, with a medium-term return of 6–9 years, benefiting from public incentives.

2. Functional real estate (non-speculative)

Priorities are logistics warehouses, service units in medium-sized cities, and business spaces, especially in the Albanian Riviera where prices are rising 10–15% per year. Returns come from rent, not prices, ensuring stable cash flow. This sector has a KTR of 5/10, stabilized cash-flow, and a return cycle of 7–10 years.

3. Supportive & quality tourism

Massive hotels face seasonality and overcrowding. Solutions include structured guesthouses, tourist services, wellness, and natural/cultural tourism, with rapid growth after the pandemic. This segment has a high margin, but KTR of 6/10 due to seasonality. Return cycle is 5–8 years, requiring careful reservation management.

4. Agro-processing & food logistics

Main problems: unprocessed production, post-harvest losses, dependence on imports. Albania has the least developed agro-industry in the region, but investments in collection, processing, refrigeration, and standardization for regional export offer potential. This sector has KTR 5/10, controllable cash-flow, and support from EU/IPARD funds, ensuring sustainable returns.

5. Exportable professional services

Advantage: low cost and flexible human capital. The sector includes IT & outsourcing, accounting, legal, payroll, and digital services for foreign markets, with Albania as a regional digital leader (AI ministry, e-government services). This segment has low risk (KTR 3/10), high returns, 2–4 year return cycle, and scaling opportunities.

Where not to invest in Albania in 2026?

Firstly, in speculative construction without end-users. This type of investment has high risk due to market saturation and inflated prices that often do not reflect actual demand. The project may end with unused spaces, reducing returns and exposing the investor to unnecessary losses. This sector is considered KTR >7/10 with high risk.

Secondly, in businesses only for a narrow local market. Investments targeting only the local market are influenced by short-term policies and low consumption. High dependence on subsidies, local politics, or seasonal consumption cycles increases the risk of losses. If the city or region lacks steady client flow, business cash-flow may be unstable. These appear as KTR >7/10 with high risk.

Thirdly, projects without formalization. Investments without clear legal registration, formal contracts, or institutional oversight have obvious corruption issues, even though SPAK and other institutions are gradually strengthening. The risk of capital loss is high and often unpredictable. These appear as KTR >7/10 with high risk.

Fourthly, sectors dependent on short-term politics. Some government programs or initiatives, like “Albania 1 Euro” for mountain land, offer investment opportunities at very low prices, but the risks are unclear and short-term. Conditions can change with laws or administrative decisions, making returns uncertain and delayed. These appear as KTR >7/10, warning investors of high risk (>7/10).

Logical model for operational decision-making

For every potential investment, four key questions must be followed to flag risk and confirm sustainability. Only “yes” answers for each indicate the investment has economic sense and sustainable cash-flow.

Who really pays?

The goal is to ensure there is real demand from clients or tourists, not only price expectations or incentives. For example, in tourism, investments should not be made in structures without reservations or potential visitors. In agro-processing, the flow comes from contracts with regional markets and exporters, not only subsidies.

Is there a steady cash-flow?

The investment must generate stable cash-flow, not dependent on subsidies, short-term programs, or extreme seasonality. Logistics warehouses and functional properties ensure regular monthly rent, while small guesthouses must be planned with advanced bookings and service diversification (wellness, guides, transport).

Can the project survive without subsidies?

This test simulates resilience in crisis scenarios (inflation, rising costs, lack of clients). The project must be able to operate without state support, ensuring return of capital in medium or long term.

Is there demand outside the season?

For highly seasonal sectors (tourism, agro), service or product diversification must be planned to maintain stable flow year-round. For tourism, this can include natural, cultural, or health packages; for agro-processing, storage and regional export.

This model allows smart decision-making, avoiding impulsive investments and focusing on sustainable cash-flow, measurable returns, and resilience in crises.

Cold economic assessment?

In Albania, 2026, profit comes from function and service, not from expectations of rapid growth. Value comes from service, not property, and sustainability matters more than rapid growth. Smart investment generates stable cash-flow, survives crises, and offers measurable return on invested capital, especially in the context of EU integration and sustainable economic growth. Albania is progressing toward EU membership, opening negotiation chapters at record speed, which increases attractiveness for investors.

For more information and analysis you could read Where to invest in Albania in 2026?

Leave a Reply

You must be logged in to post a comment.