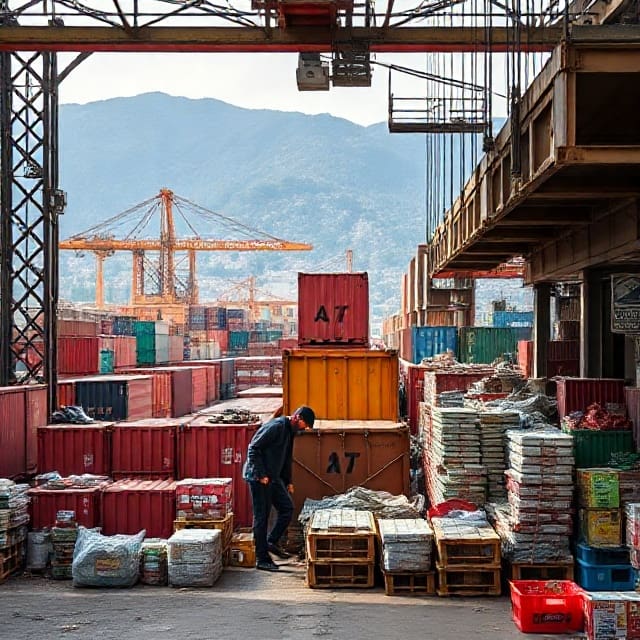

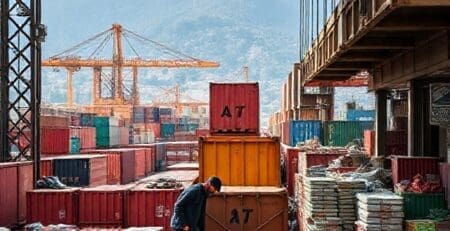

Imported inflation and the sensitivity of the Albanian market

Albania is a small and open economy, highly sensitive to global price fluctuations, especially in food, energy, and industrial goods. Despite favorable geography, a climate suitable for agriculture and agro-processing, and abundant natural resources, this potential has not been fully leveraged to create a stable and internationally resilient market.

International price increases are immediately reflected in local prices, while decreases are rarely transmitted, fueling a persistent inflationary pressure that the current market and policies cannot neutralize.

One key reason why imports do not translate into price reductions is exchange rate volatility and depreciation of the Albanian lek. When the national currency loses value against the dollar or euro, imported goods are purchased at higher costs, offsetting any international price drops. This acts as a negative buffer, making the market sensitive to international shocks and feeding a continuous inflationary spiral. Conventional monetary policy by the Bank of Albania has limited effect, as rising import costs are directly passed on to consumers.

The structure of the Albanian market amplifies this problem. Strategic imports are controlled by a small group of operators with significant pricing power, transmitting global price increases to consumers. Domestic production remains fragmented and insufficient to provide real alternatives. Most companies are small, with minimal capacity for exports or competing with imports, and investments in infrastructure and technology, although present, are not coordinated with policies to strengthen competition and transparency. The result is a market where international price decreases do not reach consumers, while increases are immediately reflected.

High informality, tolerated by successive governments, further reinforces this problem. Informal operators, who do not report transactions or pay taxes, retain their profits by raising prices irresponsibly. Although Albania has invested in market monitoring technology and electronic import registration, insufficient institutional capacity and weak distance from corruption make these tools formalistic, failing to change the market reality or lower prices effectively.

The combination of informality and currency depreciation indicates that implemented policies are based on unrealistic assumptions, presuming the market functions according to classical competition logic. Concrete examples from the 2022 crisis show that increases in grain and oil prices immediately translated into bread, oil, fuel, and transport service costs, while international price reductions were not reflected due to currency depreciation and informal barriers to real competition. This highlights structural weaknesses of the Albanian market, where a concentrated market and small enterprises cannot provide real alternatives, and technology and investments fail without institutional coordination and effective policies.

Fiscal and monetary policies used so far have been limited and often formalistic, assuming that international price reductions would automatically reach consumers. The result is a system unprepared to absorb global fluctuations, where short-term measures like energy subsidies or benefits for importers slow symptoms but do not address the root cause. This approach directly affects the market’s sensitivity to global inflation, leaving Albania more exposed than neighboring countries.

Compared to the region, the difference is clear. In North Macedonia and Montenegro, markets are more integrated with the EU, strategic import controls are stronger, and competition is more developed. These countries better absorb global price increases and decreases, while operators cannot pass all increases to consumers without oversight. In the EU, strategic funds, structured subsidies, long-term contracts, and competition supervision reduce sensitivity to external shocks and ensure that international price decreases reach consumers.

In contrast, Albania lacks similar instruments, remaining exposed to any global fluctuation. Policies based on unrealistic assumptions and formalistic implementation have created a situation where investments in technology and infrastructure do not yield expected effects. The periodically depreciating currency acts as a negative buffer, raising import costs for all goods and services—from food and fuel to industrial and technological equipment.

Consumers remain exposed to every global price fluctuation, while the concentrated and tolerated informal market makes it sensitive and unstable. Global price decreases rarely reflect locally, while increases are immediately transmitted. This market sensitivity stems not from global fluctuations themselves, but from structural weaknesses and the lack of sustained political and economic coordination.

Ultimately, domestic production in Albania, fragmented and limited in capacity, cannot offer real alternatives to imports, preventing effective competition. Technological investments, without strong supervision and transparency mechanisms, fail to impact price reductions, while high informality prevents consumers from benefiting from potential international price drops.

Addressing these challenges requires a national discussion on an integrated, long-term strategy combining specialized and coordinated domestic production growth, strengthened competition across sectors, improved logistics and supply chains, and combating informal practices and corruption. At the same time, real (not paper) guarantees of strategic reserves for basic goods and energy, together with investments accompanied by effective control and transparency mechanisms, can reduce market sensitivity to global fluctuations and strengthen the resilience of Albania’s economy.

Leave a Reply

You must be logged in to post a comment.