Foreign Investments in Albania and Kosovo with nominal growth, but fragile transformation

Foreign Direct Investments (FDI) have been a driving force for the economic development of Albania and Kosovo over the past two decades, reflecting shared challenges of the post-communist transition, such as the lack of domestic savings and the need for foreign capital to spur growth.

Both countries have benefited from FDI in bringing capital, technology, and connections to European markets, but with a shared tendency toward sectors with quick returns, such as real estate, at the expense of diversification into manufacturing or technology.

However, the differences are notable.

Albania, with a larger market and more advanced integration into the EU accession process, has attracted higher absolute FDI flows, while Kosovo, constrained by tensions with Serbia and a smaller economy, has shown greater resilience relative to GDP, thanks to recent reforms like the Free Trade Agreement with EFTA (January 2025) and the first sovereign credit rating (BB-, April 2024).

From 2000 to 2007, both countries experienced an initial FDI boom, driven by economic liberalization and infrastructure projects.

In Albania, flows were concentrated in energy and construction, with investments from Italy, Greece, and Turkey peaking around 2007.

In Kosovo, post-1999 war, FDI focused on reconstruction and services, supported by the diaspora and European countries, but at lower levels due to political instability.

The 2008 global financial crisis led to a sharp decline in both, with minimal flows until 2013, though existing companies maintained their presence through reinvestments. Between 2014 and 2019, Albania saw a shift in FDI toward real estate, tourism, and services, leveraging low labor costs and its geographic position, while Kosovo leaned toward real estate and financial services, fueled by remittances.

Since 2020, the pandemic and geopolitical conflicts, such as the war in Ukraine, have created a consolidation model where reinvestments dominate, but Kosovo has benefited from reforms enhancing its relative attractiveness.

In the 2023-2025 period, FDI flows show nominal growth but with differing structures.

In Albania, flows reached €1,583 million in 2024 (+5.6% from €1,499 million in 2023), mainly from reinvested earnings (+6.2%, from €803 million to €853 million), while new capital investments fell by 3.5% (from €734 million to €708 million). Debt instruments shifted from a net outflow of -€38 million in 2023 to a net inflow of +€23 million in 2024, reflecting more favorable financing conditions.

In Kosovo, net FDI flows rose to €850 million (US$907 million) in 2024, from €816 million in 2023, with an increase of €34 million, driven by real estate and energy. As a percentage of GDP, Kosovo outperforms, with FDI at 8.68% in 2023 and 8.31% in 2024 (GDP: ~€10.47 billion in 2023, €11.15 billion in 2024), compared to 7-8% in Albania (GDP: ~€25 billion in 2024).

In the first half of 2025, Albania saw strong growth in real estate (+40%, €253 million), but contractions in manufacturing (-35%) and energy (-20%), while Kosovo is expected to moderate flows to 6.1% of GDP. Albania’s total FDI stock reached €15.543 billion in Q1 2025, while Kosovo’s stock remains lower but grows steadily due to reinvestments.

Comparative trends of Foreign Direct Investments (FDI) in Albania and Kosovo (2023–2025)

To illustrate the comparison of key FDI trends between Albania and Kosovo, below is an expanded table based on official reports from the Bank of Albania, Central Bank of Kosovo, UNCTAD, and World Bank (updated to Q1 2025).

For Kosovo, estimates for the first half of 2025 are based on recent trends (modest ~4% growth in real estate and energy, but contraction in manufacturing). The table covers the 2023–2024 period (annual) and the first half of 2025 (estimated).

| Field / Period | Albania 2023–2024 | Albania First Half 2025 | Kosovo 2023–2024 | Kosovo First Half 2025 (est.) |

|---|---|---|---|---|

| Total FDI Flows | +5.6% (€1,583M from €1,499M) | Similar trend, focused on real estate (+40%, ~€253M) | +11.5% (€850M from €816M) | Modest ~4% growth (~€430M), dominated by real estate |

| Capital/Equity Investments | -3.5% (€708M from €734M) | Still weak, especially in industrial sectors (-10%) | +5% (~€200M, mainly in energy) | Stagnation, with decline in manufacturing (-15%) |

| Reinvested Earnings | +6.2% (€853M from €803M) | Moderate growth, concentrated in existing companies (+7%) | +8% (~€300M, from diaspora and energy) | +5%, mainly in financial services |

| Debt Instruments | From -€38M to +€23M | Stable flows (+€10M in energy) | From -€50M to +€20M (in infrastructure) | Positive, ~+€15M in renewable projects |

| Dominant Sector | Energy and construction (30%) | Real estate (29%) | Real estate (76%) and energy (15%) | Real estate (78%), with growth in ICT (5%) |

| Declining Sectors | Manufacturing, energy (-15%) | Manufacturing -35%; energy -20% | Manufacturing and agriculture (-10%) | Manufacturing -25%; infrastructure -10% |

| Diversification | Limited (focus on real estate) | High concentration in real estate | Weak (76% in real estate) | Remains low, but growth in renewables |

The sectoral structure reveals concerning similarities.

Capital is shifting from manufacturing to real estate and services, prioritizing liquidity and return security.

In Albania, real estate accounts for 29% of FDI in Q1 2025, followed by finance (17%) and extractive industries (14%), with contractions in manufacturing and energy.

In Kosovo, real estate dominates at 76.5% in 2025 (up from 65-67.8% in 2022-2023), followed by financial services and energy, while ICT, infrastructure, and renewables grow modestly.

This shift creates an “illusion of stability,” where nominal growth inflates values through construction without boosting productivity or exports, risking “capital lock-in” in non-productive assets.

Albania has a stronger historical base in energy, while Kosovo relies more on diaspora, with investments from Albania reaching €468 million in 2024, making it the fifth-largest investor.

The impact on the real economy is similar but nuanced.

In Albania, “statistical” growth supports short-term financial stability and creates seasonal jobs in construction and tourism but weakens global competitiveness.

In Kosovo, reliance on remittances (fueling consumption) drove GDP growth of 4.9% in the first half of 2024, but the focus on real estate increases inequalities and risks price bubbles.

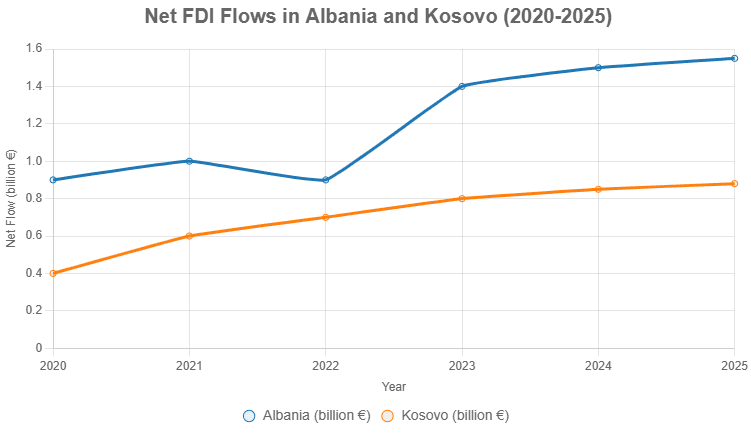

To visualize the FDI trends in Albania and Kosovo from 2020 to 2025, below is a chart showing annual net flows in billion euros (converted from data by World Bank, UNCTAD, and Bank of Albania/Central Bank of Kosovo).

The chart shows overall nominal growth but with a shift toward non-productive sectors.

This chart illustrates that Albania has higher absolute flows, but Kosovo shows steadier growth relative to GDP (~8% vs. 7-8% in Albania). Both countries peak in 2023-2024, driven by reinvestments and real estate, but face the risk of stability illusions without diversification.

Both suffer from a lack of skilled employment, with FDI generating short-term jobs while manufacturing remains passive.

Regional competitiveness is low.

Kosovo benefits from “friend-shoring” for the EU via the Stabilization and Association Agreement, while Albania relies on low labor costs without strategic advantages. Compared to the region, North Macedonia saw a 117% FDI increase in 2024 (€1.2 billion), surpassing both.

Strengths include steady reinvestment growth, signaling macro stability, and improved international debt flows.

In Kosovo, the first solar auction (April 2024) and renewable energy growth signal potential, while Albania maintains a positive trend compared to regional stagnation.

Weaknesses are similar: lack of diversification, declining new capital investments, focus on speculative activities, lack of sectoral transparency, and inadequate public policies.

Kosovo faces an informal economy, high unemployment among women and youth, and tensions with Serbia, while Albania struggles with corruption and legal uncertainty.

Prospects indicate a distorted structure, with the real sector overshadowed by real estate, increasing reliance on construction and weakening the productive base.

For 2025, Albania forecasts moderate growth at 3.4%, while Kosovo projects 4%, both vulnerable to external shocks.

For public policy, strategies are needed to redirect productive capital through tax incentives, procedural simplifications, legal climate reinforcement, and curbing speculative flows via progressive taxation.

Kosovo can leverage the EU Growth Plan (€882.6 million for 2024-2027), while Albania must advance EU integration.

For investors, both remain attractive for short-term engagements but hold potential in underdeveloped sectors like value-added agriculture, IT, and logistics.

In summary, Albania has higher absolute flows and a more consolidated base, but Kosovo shows greater efficiency relative to GDP and recent reforms. Both suffer from a lack of structural transformation, requiring urgent interventions for sustainable development through policies that promote diversification and productive capacity.

Leave a Reply

You must be logged in to post a comment.