Exports, services and implementation of VAT rules

Albania has trade relations with the entire world, but it has important trade relations with European countries, with the USA, as well as with Asian countries. Due to completely different tax systems (as in the case of the USA or some Asian countries), the process can be quite confusing.

This clarification explores the VAT process when you export or import services between Albania and countries that do not apply VAT and instead apply sales tax.

The EU has standard rules for VAT, but these rules may apply differently in each EU country. In most cases, you must pay VAT on all goods and services at all stages of the supply chain, including the sale to the final consumer. This includes from the beginning to the end of a production process, e.g. purchasing components, shipping, assembly, supplies, packaging, insurance, and delivery to the end customer.

The average EU standard VAT rate is 21 percent, six percentage points higher than the minimum standard VAT rate required by EU regulations. In general, consumption taxes are an economically efficient way to raise tax revenue.

EU law only requires that the standard rate of VAT must be at least 15% and the reduced rate at least 5% (only for supplies of goods and services mentioned in an exhaustive list). The actual tariffs applied vary between EU countries and between certain types of products.

Sales Tax in the USA, Egypt etc.

In the USA they also have a complicated sales tax system. It is charged at the state and local level instead of the federal level, which means that tax rates vary significantly between states and even cities and counties within states.

In the US, when you pay for a good or service, state and local sales taxes are combined to create a “Combined Tax Rate.” In 2023, combined sales tax rates ranged from 0% to 13.5%.

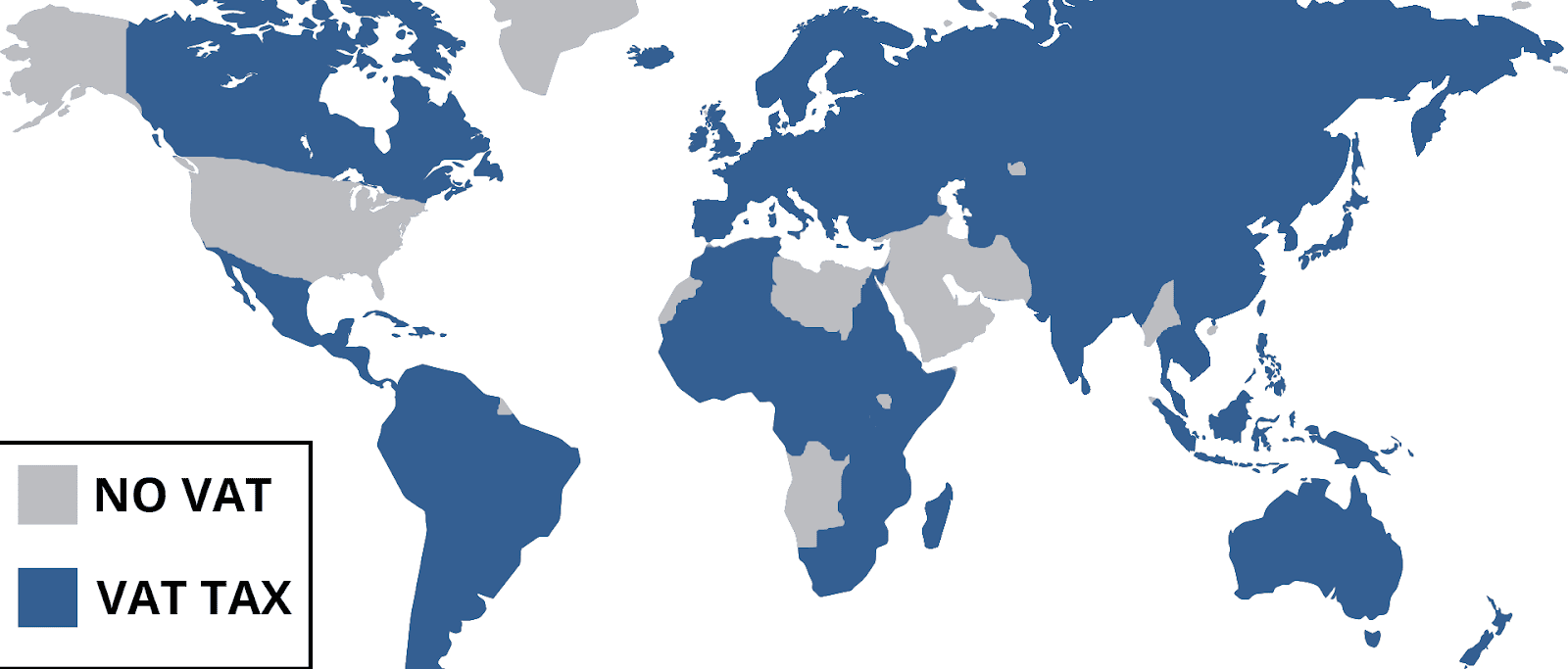

In Albania, the same rules are used on the sale of goods and services as in the EU, but with few specifics on tax rates. In Albania, the sales tax known as “Value Added Tax” or “VAT” has been applied since 1996 (170 countries apply VAT). Every VAT-registered business must apply VAT to its products or services, except in certain circumstances.

Compared to the United States, Egypt, etc. The VAT rates in Albania are simple and are charged the same throughout the country, where:

– 20% standard rate for most goods and services (Article 48 of the law)

– 6% reduced rate on certain goods and services (e.g. accommodation, any supply of services to 5-star hotels/resorts, agritourism, audiovisual media advertising, public transport, books, provision of services construction works for state investments of sports clubs, investments of private entities in sports infrastructure)

– 0% goods and services for export, articles 57 – 62, 64 – 67 (all goods and services exported according to the Customs Code, international transport, as well as goods in the traveler’s personal luggage)

– exemption from VAT for supplies of goods and services according to Article 51, 56, as well as certain activities according to Article 53, 54,

Any business in Albania that has a VAT taxable turnover of over 10 million Lek/year (over 95,000 euros, but depends based on exchange rate) must register for VAT and start charging VAT for its products or services, according to the above clauses.

Any business can also voluntarily register for VAT if sales/revenues are below the threshold and would be beneficial to the business.

The export of goods and services to all countries of the world is assessed at zero for VAT. In other words, you do not need to charge VAT on exported goods or services.

However, you will need to keep sufficient proof of export, such as invoices, delivery notes, a bank statement confirming the transaction or a customs document. This evidence must be kept for at least 10 years.

You will also need to report the net sales value on your VAT return, which includes the total value of sales and all other products excluding VAT.

If your business is in the VAT exempt scheme, then this export will include the amount of the sales value on which the goods or services are paid without VAT.

VAT for services between Albania and other countries is determined by the country of supply.

The general rule of place of supply is:

For business-to-business (B2B) service sales, the place of supply is where the customer (receiving business) belongs.

For business-to-customer (B2C) service sales, the place of supply is where the supplier (sending business) is located.

There are only a few exceptions to the country of supply rule, including:

Services are directly linked to a specific location (eg real estate services, etc.).

Some services offered to non-businesses are:

Typically, B2C transactions would have a place of supply where the supplier is located. However, services such as advertising, consultants, lawyers, accountants, engineers, IT and services provided electronically will have a place of supply, that of the customer.

You can see a complete list of special rules for certain services on the tax website.

Let’s take some examples of VAT apply on exports of services in USA

According to the general rule, if your business in Albania offers services, e.g. in the US and the country of supply is the US, then this transaction will be outside the scope of VAT. You will not need to charge VAT and can mark this in the relevant box on your VAT return.

But, if your business in Albania is offering services, e.g. in the USA and the country of supply is Albania, then you will need to calculate the VAT and charge it at the appropriate VAT rate.

VAT on services – examples of place of supply

The VAT process for services sold between Albania and the USA can be quite complex in bureaucratic procedures, but simple in logic. We will describe some examples.

Example 1

Your VAT-registered business in Albania offers IT software services to individuals (not businesses) as well as businesses located in the USA. Both types of transactions have as the place of supply of your service that of the customer and you will not have to pay VAT.

Example 2

Your VAT registered business is providing construction services to a country and to a business in the US. Even in this case, you will not need to pay VAT.

Example 3

Your VAT-registered business in Albania sells services to an individual in the US (not a business) that is not considered one of the special exempt services. The place of supply would be Albania and you would pay VAT.

Leave a Reply

You must be logged in to post a comment.