Economic growth model 2026–2028 according to ERP with growth without structural change

The data on real growth and sectoral contribution for the period 2022–2028, according to the Economic Reform Program (ERP) 2026–2028 (in Albanian), show that the Albanian economy, after maintaining a relatively stable growth rate of around 4% per year, will continue in the medium term to follow this form of growth, even though it is fundamentally problematic from the perspective of long-term development.

Growth will be supported mainly by non-productive, non-exporting sectors with low added value and a narrow base, while the sectors that should constitute the real basis for structural transformation remain peripheral or in decline.

In simple terms, the economy will grow, but it will not develop. Let us analyze the indicators to be more substantiated in this analysis.

1. Agriculture, Forestry, and Fishing

In 2022, the sector recorded solid growth of 4.8%, contributing 0.9 percentage points to GDP growth, as a result of post-pandemic recovery and some investments in rural infrastructure. In 2023, growth falls sharply to 1.4%, with a contribution of only 0.2 p.p., suggesting negative impacts from climatic conditions or unfavorable prices in agricultural exports. The year 2024 brings a slight recovery to 2.0% (0.7 p.p.), while in 2025 the sector stabilizes at 1.7% (0.9 p.p.), reflecting an unsustainable pace influenced by subsidy policies with limited structural effect.

In the 2026–2028 horizon, growth is expected to drop to minimal levels: 0.2% in 2026, 0.3% in 2027, and 0.0% in 2028, with contributions approaching zero. This practically indicates total stagnation of the sector.

This trajectory shows that agriculture is losing its function as a social and economic buffer, especially for rural areas. Instead of transforming into a modern agribusiness integrated into value chains and export-oriented, it remains fragmented, with low technology, poor productivity, and dependence on subsidies distributed without structural effect.

From the sustainable development perspective, this is one of the most critical failures in an economy that neglects its agriculture while generating emigration, rural poverty, and dependence on food imports, increasing macroeconomic and social vulnerability.

2. Extractive Industry

In 2022, the extractive industry recorded growth of 5.8% with a contribution of 0.3 p.p., but 2023 represented an extreme high point with 20.7% growth and 2.0 p.p. contribution, perhaps due to statistical base effects, global mineral price increases, or isolated projects.

In 2024, growth falls to 3.0% (0.2 p.p.), while in 2025 it stabilizes at 2.3% (0.3 p.p.), reflecting the sector’s dependence on international market cycles.

In the 2026–2028 period, the sector enters gradual decline toward stagnation with 1.0% in 2026, 0.9% in 2027, and 0.0% in 2028.

This situation shows that the extractive model is exhausted. It does not generate value chains, does not create downstream industries, does not increase productivity, and does not improve the trade balance.

From a developmental perspective, the extractive industry in Albania remains an exhausting resource, not a development engine. It consumes natural resources without transforming them into long-term economic capacities, creating a negative combination of environmental degradation and minimal economic benefit.

3. Manufacturing Industry

The manufacturing industry recorded relatively good growth in 2022 at 6.2% with a contribution of 0.7 p.p., but in 2023 it fell sharply to 0.7% with a contribution of only 0.1 p.p., perhaps due to rising energy and input costs. In 2024, the sector recovers to 3.7% (0.4 p.p.), while in 2025 growth falls again to 2.1% (0.2 p.p.).

In 2026–2027, slight growth of around 3.1–3.2% is expected, but in 2028 the sector falls again to 0.2%, reflecting a lack of consistency and a weak structural base.

The manufacturing industry is theoretically the sector that should be the main pillar of economic transformation. In practice, the data show a sector with fluctuations, unstable growth, and relatively low contribution to overall growth.

Trend analysis shows that the Albanian economy is not industrializing in reality. Investments in technology, automation, human capital, and external market linkages are lacking. Manufacturing remains mainly oriented toward low-value activities, often subcontracted, with little impact on national productivity.

Structurally, this is perhaps the greatest weakness of the economic model, because without manufacturing, there is no sustainable export, no productivity growth, and no real convergence with the EU.

4. Energy, Gas, Water, and Utilities

The energy sector shows a more positive trajectory compared to other sectors. Growth rises from 3.2% in 2022 to 4.7% in 2023 and reaches a peak of 6.6% in 2024, with a high contribution of 1.5 p.p., perhaps as a result of infrastructure projects and investments in energy capacity.

After 2024, the sector stabilizes at around 3–4% growth per year, with a modest but positive contribution to GDP growth.

The energy sector is one of the few showing positive signals. Strong growth in 2024 reflects infrastructure investments and capacity expansion, especially in hydro and renewable sources. After that year, the sector stabilizes at average growth levels.

However, even here, the contribution to total growth remains relatively modest. Energy has not yet been transformed into a platform for export, industrialization, or technological transformation, but remains mostly a supportive sector.

From the sustainable development perspective, this sector represents one of Albania’s most real opportunities. If linked with industry, regional exports, and green transition, it could become one of the new pillars of structural growth. But currently, the potential remains fully untapped.

5. Construction

Construction is the dominant sector throughout the period. In 2022, growth reached 13.2% with a contribution of 1.9 p.p., mainly due to post-earthquake recovery and large urban investments. In 2023–2025, the sector stabilizes around 4.5–5% growth, remaining the main contributor to GDP growth.

In the 2026–2028 period, growth falls to around 3–4%, but the sector remains one of the main pillars of growth.

Construction is the dominant sector throughout the period. In 2022–2025 it gives the largest contribution to GDP growth, reflecting post-crisis recovery, urban investments, and a real estate boom. Even though its contribution is expected to decline in 2026–2028, it remains a core pillar.

The fundamental problem is that construction is a non-productive sector in developmental terms. It does not create exports, does not increase long-term productivity, and does not build reusable economic capacities. On the contrary, it raises property prices, encourages speculation, concentrates capital, and creates bubble risk.

Structurally, construction is a symptom of an economy that consumes value rather than producing it.

6. Trade

Trade maintains a stable contribution throughout the period, with growth around 3–4% and contribution around 0.6–0.7 p.p. per year. It reflects an economy driven by domestic consumption and circulation of imported goods.

Trade maintains a stable contribution throughout the period. It reflects an economy driven by domestic consumption and circulation of imported goods.

This sector is important for short-term stability, but it does not produce development. It does not generate net exports, increase productivity, or create value chains.

Essentially, trade in Albania is a distribution channel of wealth created elsewhere, not a source of its creation.

7. Tourism (Accommodation & Food Services)

Tourism is the sector with the highest real growth rates. After the post-pandemic boom in 2022–2023, with growth above 30–40%, the sector stabilizes around 8% annual growth in 2024–2028, giving a constant contribution of around 0.6–0.7 p.p. to GDP growth.

Tourism is the sector with the highest real growth rates and a stable contribution to GDP growth. After the post-pandemic surge, it stabilizes at high levels.

However, the structure of tourism remains problematic: high imports, pronounced seasonality, low-productivity work, and heavy pressure on the environment and infrastructure.

Tourism is becoming a numerical engine of growth, but not a real development engine. It increases monetary circulation, but not necessarily structural well-being.

8. Other Public & Administrative Services (Education, Health, Administration, Social Security)

Year-by-year specific data are not individually detailed, but the general trend shows constant growth with a modest contribution of ~0.2–0.4 p.p. to GDP each year, based on the public sector aggregate.

Public services (education, health, administration, social security) show steady growth and modest contribution throughout the period. They are necessary for social cohesion and institutional stability, but they are not a source of productive growth.

Public services (education, health, administration) have stable growth and modest contribution. They are necessary for social cohesion and institutional stability, but are not a source of productive growth.

Without links to productive sectors, without deep digitalization, and without orientation toward new skills, these services remain supportive, not transformative.

Summary of Key Results and Contributions

| Sector | Trend 2022–2025 | Trend 2026–2028 | Contribution to GDP Growth | Sustainability & Value Chain Integration Interpretation |

|---|---|---|---|---|

| Agriculture | Sharp decline | Zero/stagnation 🔻 (gradual decrease) | No! Lack of transformation, environmental risk | No! Fails to modernize or integrate; environmentally vulnerable; little sustainable development. |

| Extractive Industry | Peak then decline | Stagnation 🔻 (minimal) | No! Unstable, no integration | No! Unstable, not integrated into value chains; limited long-term development potential. |

| Manufacturing | Fluctuating, weak recovery | Low but positive 🔸 (modest) | Few. Potential, but needs innovation | Few. Some potential, but inconsistent growth and low innovation; needs investment for value-chain integration. |

| Energy & Utilities | Growth, then stable | Modest + 🔹 (positive) | Yes! Towards green transition | Yes! Shows positive signs; moving towards green transition and long-term sustainable growth. |

| Construction | High → Stable | Lower 🔸 (declining) | No! Over-reliance risk | No! Dominant but non-productive; over-reliance risk; does not support structural development or value chains. |

| Trade | Constant + | Constant + 🔹 (stable) | Few! Does not reduce trade deficit | Few! Supports domestic circulation but limited contribution to sustainability or value chains; does not reduce trade deficit. |

| Tourism | Boom → Stable | High 🔹 (dominant) | Not fully! Seasonal, unsustainable | Not fully! Seasonal, import-dependent, and unsustainable; high short-term growth but limited long-term development. |

| Public Services | Stable + | Stable + 🔹 (modest) | Yes! For social stability, not productive | Yes! Supports social stability and cohesion, but not productive; does not generate economic value. |

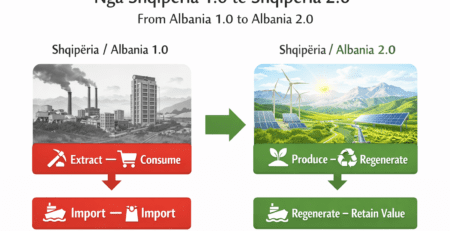

Overall, the structure of Albanian economic growth for the period 2022–2028 shows a clear model where growth is dominated by construction, tourism, and trade, and productive sectors (agriculture, industry, manufacturing) are stagnant or declining.

Exports and productivity are not expected to be drivers of growth, while even energy remains fully untapped potential.

This economic model will circulate wealth but will not create capacities, and it will grow numerically but will not converge in reality.

From a development perspective, Albania is heading toward a structural trap with average growth, without industrialization, export base, or high productivity.

This is precisely what economic literature calls “exhausted growth,” a growth that does not produce sustainable development and, in the medium term, leads to stagnation, emigration, and fiscal pressure.

Based on this document, which lacks a medium-term perspective for deliberate movement toward manufacturing, modern agribusiness, technology, and logistics, it is clear that the growth chart will continue to look attractive, but the economy will remain structurally weak.

Leave a Reply

You must be logged in to post a comment.