Distribution of the tax burden according to Kosovo’s budget expenditures

For reasons of planning expenses on the basis of stable incomes, a conservative approach has been applied to the evaluation of the effect of these measures. Consequently, spending will be able to be kept at a manageable level, and with the goal that spending commitments will be based on funding from sustainable sources.

In order to create confidence in a fiscal system that works to increase the well-being of the lives of its citizens, it is necessary to make an analysis regarding the recovery of taxes paid as a tax burden in public expenditures for taxpayers.

Budget expenditures in 2023 (Table) are with an annual increase of 4.2% of GDP.

| Budget expenditures to GDP in Kosovo, 2021 – 2023 | % GDP | |||

| Budgetary expenses | 2021 | 2022 | 2023 | Diff. 23/21 |

| Expenses for salaries and allowances | 8.4% | 7.3% | 7.6% | -0.8% |

| Expenditure on goods/services and subsidies/transfers | 14.8% | 16.0% | 16.2% | 1.4% |

| Capital investment expenses | 5.3% | 4.7% | 8.3% | 3.0% |

| Expenditure on public debt | 0.4% | 0.4% | 0.5% | 0.1% |

| TOTAL | 28.9% | 28.4% | 32.6% | 3.7% |

Public administration salaries are with an annual increase of 18.5% from 2022 due to the implementation of the new law on salaries in the public sector in February 2023.

Transfers to the population and businesses have a smaller variable weight, and the government’s operating expenses have a better growth with the joint increase of the two groups of expenses amounting to 0.2% of GDP from 2022. Subsidies and transfers had a small increase , since in 2022 a significant distribution of the budget was realized from the implementation of the measures of the Economic Revival Package, carried over into 2023.

Capital expenditure is on a noticeable increase of 8.3% of GDP with an increase of 3.6% of GDP from 2022, the year in which capital investments were fulfilled up to 71.3% of the budget programme. The financing structure of capital expenditures consists of the regular budget with about 82.6%, followed by own revenues (13.6%), external borrowing financed by investment clauses (3.2%), and regular external borrowing (0.7%). .

Expenditures for public debt are 0.5% of GDP with an increase of 0.1% of GDP from 2022[1]

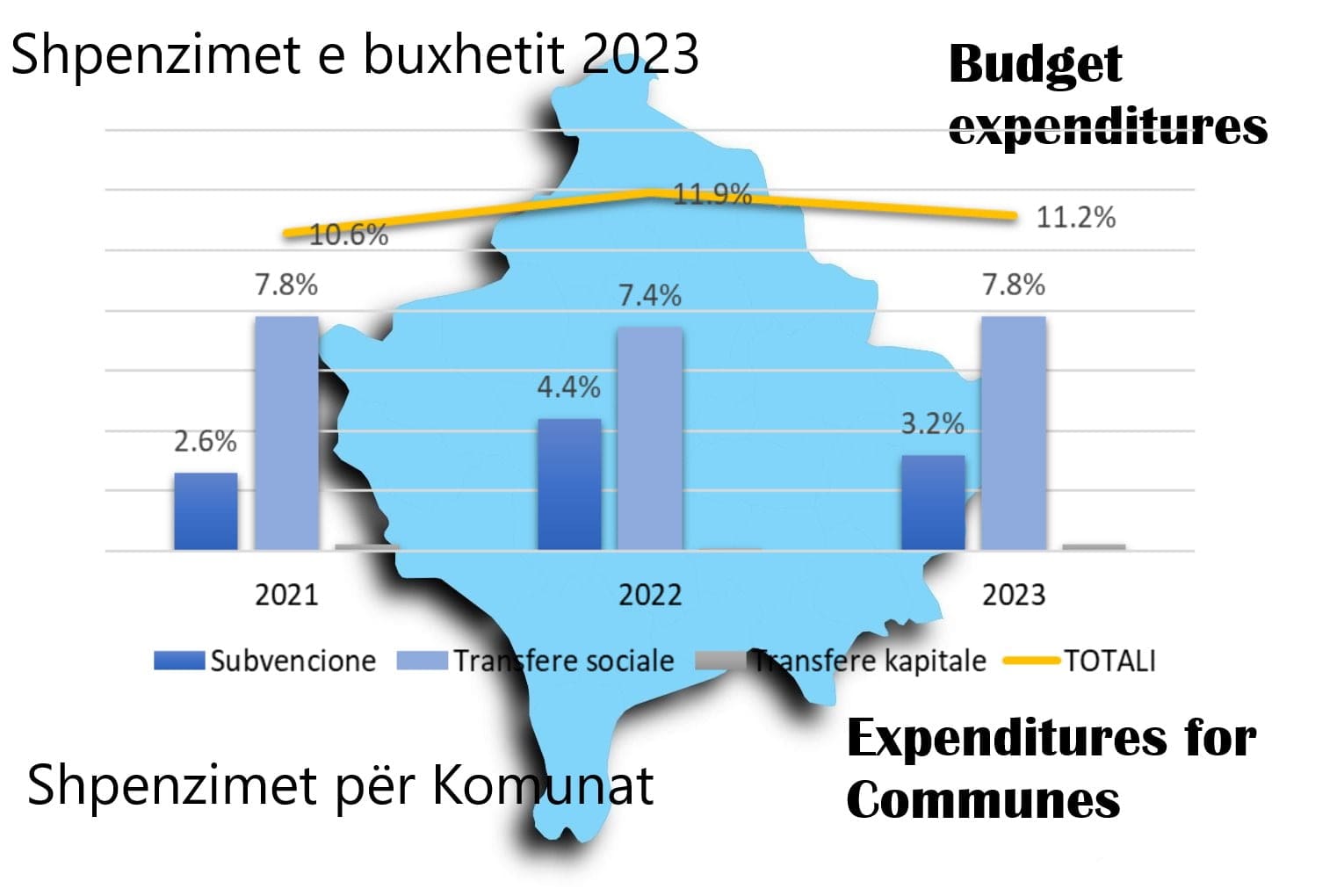

| Expenditures for Communes to GDP in Kosovo, 2021 – 2023 | % GDP | |||

| 2021 | 2022 | 2023 | Diff. 23/21 | |

| Subsidies | 2.6% | 4.4% | 3.2% | 0.6% |

| Social transfers | 7.8% | 7.4% | 7.8% | 0.0% |

| Capital transfers | 0.2% | 0.1% | 0.2% | 0.0% |

| TOTAL | 10.6% | 11.9% | 11.2% | 0.6% |

Expenditures for municipalities according to the fiscal rule of the 2023 budget and its actual implementation are seen to have decreased by -0.7% of GDP with a decrease of -5.9% from 2022.

According to the 2024 budget document, “during the year 2024, a more pronounced increase is expected in the category of salaries and allowances and the category of subsidies and transfers, with 23.0% and 10.9%, respectively. Other expenditure categories are also expected to increase, more specifically, goods and services are expected to increase by 9.3%, municipal expenditure by 1.4%, and capital expenditure by 1.1%.”

From the comparison of tax revenues in personal income with budget expenditures, which coincide with them, it can be seen that tax revenues justify only 36% of budget expenditures for state administration salaries.

Only 24% of combined corporate income tax and property tax revenues are justified for capital investment expenditures.

Other destinations of budget expenditures (for local government and for operating expenses), along with filling the parts not covered by taxes dedicated to capital expenses and salaries are covered by indirect taxes, which meanwhile also go to other local expenses.

[1] https://kk.rks-gov.net/decan/wp-content/uploads/sites/9/2024/03/Ligji-Nr.-08-L-260-Ndarjet-Buxhetore-2024.pdf

Leave a Reply

You must be logged in to post a comment.