Property Taxes around World

A report published in the United States in 2014 concluded that property tax is often identified as taxpayers’ “most hated tax,” surpassing both income tax and sales tax in their low estimation. Not that governments seem to be aware of this, judging by the frequency with which new real estate taxes, or property tax reforms, appear in Tax-News on an almost weekly basis.

Introduction

According to the Council On State Taxation (COST) and the International Property Tax Institute (IPTI) in the study entitled “The Best and Worst of International Property Tax Administration: Scorecard on State and International Property Tax Administrative Practices,” while as a percentage of gross domestic product, property taxes are said to vary from 0-4 percent, the total property tax burden in the US, both at the individual residential and business level, still reaches over USD488bn.

Viewed from a business perspective, at USD228.7bn, US property taxes accounted for over 35 percent of the total state and local tax burden imposed on business in 2012, far exceeding all other business taxes imposed by state and local jurisdictions. “Contrary to current economic trends,” it is pointed out that amount is seen “to steadily increase year after year.”

However, as unpopular as they are, property-based taxes provide substantial percentages of funding for vital public services in different countries.

In the US, property taxes provide approximately 65 percent of local school revenues, and, says the report, “international reliance on property taxes is similar,” with the tax the primary funding mechanism of local services, including public education, in many countries around the world. In the UK for example, it provides 50 percent of annual local government revenue.

United Kingdom

The UK is a good place to start our round up of recent property tax developments, where a debate is raging about proposals for a so-called “mansion tax” on high-value properties.

A mansion tax is currently supported the opposition Labour Party, and the proposal is expected to be given prominent billing in the party’s manifestos ahead of the May 2015 general election.

Under Labour’s plans, owners of properties worth more than GBP2m (USD3m at the time of writing) would pay a “mansion tax” of at least GBP250 a month.

According Labour finance spokesman Ed Balls, the tax would be progressive.

“Owners and investors in properties worth tens of millions of pounds should make a much bigger contribution,” he said. “And we will also look at asking overseas owners of second homes in the UK to make a larger contribution than people living in their only home.”

The Liberal Democrat Party, the Conservative Party’s junior partner in the governing coalition, has long called for a UK mansion tax. However, UK Deputy Prime Minister and Liberal Democrat leader Nick Clegg has indicated that his party now favors council tax reform over the introduction of a “mansion tax.”

When asked in January 2015 if he backed both the introduction of a “mansion tax” and new council tax bands for higher-value properties, Clegg stressed that the Liberal Democrats’ approach is “very much a banded approach, in effect extending council tax bands.”

The party would appear to be divided over the two approaches, however, with senior Lib Dems, including Business Secretary Vince Cable, still in favor of a mansion tax.

A mansion tax is not supported by the Conservative Party, which argues that it will punish modestly wealthy property owners who, through no fault of their own, have seen the value of their houses rise as a result of recent property booms, especially in London and the South East of England.

The idea was also discredited by the Centre for Policy Studies, a conservative think tank, in a report published in February 2015. This report argued that there is no longer a case for a UK “mansion tax,” as recent stamp duty reforms have significantly increased the tax burden on higher value properties.

Ireland

Across the Irish Sea, the Irish Government has been bedding in a new property tax, a stipulation of its bail-out package which the country recently exited.

The Irish Government on September 4, 2014, finalized implementation of the new local property tax (LPT). The LPT is charged at 0.18 percent of the market value of properties worth up to EUR1m (USD1.14m at the time of writing), and at 0.25 percent on any excess value over EUR1m. Property values are organized into a number of bands, and the tax liability is calculated by applying 0.18 percent to the mid-point of the relevant band.

The 0.18 percent rate is fixed for the lifetime of the current Government, but a “local decision factor,” allowing local authorities to vary the rate by up to 15 percent, will apply from 2015. 80 percent of LPT will be retained locally to fund vital public services in 2015. The remaining 20 percent will be re-distributed to provide top-up funding to certain local authority areas that have lower property tax bases due to the variance in property values across Ireland.

The Government has, however, been concerned about levels of compliance with this unpopular tax, and on February 5, 2015, the Revenue Commission released figures showing a compliance rate of 84 percent, with EUR123m (USD140.5m) in revenue collected. This is substantially lower than the compliance rates for the transitional LPT in 2013 and 2014.

Italy

Indeed, other property tax developments in Europe attest to the COST/IPTI assertion that property taxes are deeply unpopular. It has been well documented how that Italian Government was forced to back down over its plan to extend the IMU property tax to first residences – a key part of the 2014 “Stability Law.” The Government confirmed in December 2013 the cancellation of the second installment of IMU on first residences.

Companies however, continue to complain that property taxation is stifling business. For instance, in November 2014, Assimpredil Ance, an association of construction companies in the north of Italy, protested that property taxation in the country has reached such a high level as to present a serious problem for its member firms.

Claudio De Albertis, its President, stated that, “The imposition of property taxes has been seen, particularly in the last few years, as the easiest means of reply to the country’s need for additional revenue, and the principal instrument for improving its worrying fiscal deficit.”

Nevertheless, in February 2015, the Italian Revenue Agency claimed that, with regard to its revenue from unified property tax (IMU), there is a “tax gap” of EUR4.2bn, or 18.4 percent, between potential and actual collections.

France

France is another country where taxpayers are complaining of being hammered by property-based taxation, with France’s National Union of Property Owners describing the situation as “intolerable” in October 2014.

According to UNPI, municipal property taxes had increased on average by 21 percent over the previous five years. UNPI’s President, Jean Perrin, explained that two factors were responsible: a 9.65 percent increase in the official rental value of properties, and higher property taxes set by locally elected officials.

In March 2014, the French Tax Administration confirmed that 66 out of the 101 departments in France elected to increase their house transfer tax rate from March 1. The tax is imposed on transactions involving older property.

Furthermore, notary fees have risen from 7 percent to around 7.7 percent in the majority of departments in France, thereby significantly increasing the cost of buying an apartment, house, or office.

The IMF

Regardless about how we as taxpayers feel about high levels of property tax, they are often seen as part of the answer to revenue shortfalls, budget crises, and economic anomalies, especially in the somewhat dry analyses by the likes of the International Monetary Fund (IMF).

In one recent example, in February 2015, the IMF advised Slovenia to implement a number of revenue-raising reforms, including an overhaul of the property tax system.

In another, the IMF recommended in September 2014 that Denmark to reduce tax preferences for housing to reduce distortions to investment decisions.

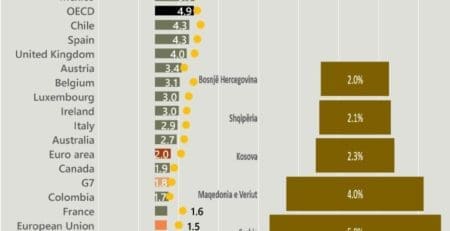

And in May 2014, urged Finland to shift some of the tax burden from direct taxes to property taxes as these tend to have less detrimental effects on economic growth and are more resilient in downturns.

Asia Pacific

It is not just Americans and Europeans who seem particularly afflicted by property taxes. Increasingly, governments in Asia-Pacific are turning to taxes on real estate as a means of managing swings in property values.

Australia

In November 2014, the Australian Treasury launched a consultation on the design of a ten percent non-final withholding tax on the disposal by foreign residents of certain “taxable Australian property.”

Under the proposals, the payer in a transaction would be obliged to withhold ten percent of the proceeds payable in relation to the transaction where the payee is a foreign resident and the transaction involves an asset classed as “taxable Australian property.”

Hong Kong and Singapore

In fact, according to a review of the Asia-Pacific residential property market by global property consultancy Knight Frank, it is Hong Kong and Singapore that have the highest tax burdens on foreign property investors.

In addition to the increased Special Stamp Duty (SSD) rate (from 10 percent to 20 percent on properties held for less than 36 months) and the introduction of a 15 percent Buyer’s Stamp Duty (BSD) on purchases of residential properties in 2012, the Hong Kong Government had also felt it necessary, in February 2013, to double the rates of existing ad valorem stamp duty (AVD) applicable to both residential and non-residential properties.

In December 2011, in addition to the standard buyer’s stamp duty of between 1 percent and 3 percent, Singapore placed an additional buyer’s stamp duty (ABSD) at a rate of 10 percent on the purchase price or market value of residential property purchased by foreigners and non-individuals, such as companies. Nevertheless, the demand for residential property remained firm and prices continued to rise, and, in January 2013, ABSD rates were raised further across the board, with the rate on all purchases by foreigners and non-individuals being hiked to 15%. Like Hong Kong, an SSD was introduced in 2010 and now applies at rates of up to 16 percent on properties resold within one year of purchase.

Taiwan

Foreign companies and individuals are also the target of higher property taxes in Taiwan, and in February 2015, the Ministry of Finance disclosed a tax reform plan that would impose much higher rates of property tax on foreigners.

While its details are still being worked out, the Government has insisted that the objective of the proposed unified tax is not to raise additional revenue, but to discourage speculation in higher priced properties and put Taiwan’s property taxes in line with international norms.

China

Significantly, the Chinese Government has announced that it is to roll out a new property registration system from March 2015. The system is said to have been designed to make property deals more secure, with the information to be held by the Government in confidence. However, the announcement is being seen as a move that will pave the way for an expansion of property taxation in China, as property taxes are currently only levied in Chongqing and Shanghai.

Thailand

Governments are attempting to use property taxes as a redistributive mechanism, to even out income inequality between rich and poor. Thailand is one country trying to do this, with General Prayuth Chan-ocha, Chief of the military-led National Council for Peace and Order (NCPO), approving plans in August for new inheritances and property taxes. According to Thailand’s Ministry of Finance, the NCPO Chief wants the new tax system “to be a mechanism for fairness and income generation for local communities.”

Property Tax Cuts

This isn’t an entirely one-way street, and governments do occasionally grant property tax relief to certain taxpayers.

In his annual mini-Budget, UK Chancellor George Osborne announced a major shakeup of the stamp duty land tax (SDLT), effective from midnight on December 3, 2014. The new system is band-based, with each rate applicable on only the part of the property value that falls within the given band. The measure is expected to save house buyers around GBP800m a year in stamp duty.

In January 2015, the Philippines’ Bureau of Internal Revenue issued a Revenue Memorandum Circular that enforces reductions in real estate property tax liability for independent power producers with certain government contracts.

Egypt is another example of a country which has reduced property tax recently, introducing new exemptions and removing a provision by which an individual was taxed on the total amount of residential property they owned, rather than on the value of each unit.

Conclusion

So as we can see, governments have a variety of justifications for introducing or increasing taxes on property, but rarely do they see the need to reduce the tax burden on real estate. In an era when public finances are stretched in many countries and governments are seeking to maximize revenue, this is a situation that is unlikely to change anytime soon.

Leave a Reply

You must be logged in to post a comment.