Progressivity and base expansion of withholding tax

When withholding tax is applied to an individual on the payment he receives, he is actually giving the government an interest-free loan. In the meantime, it is not the value that matters, but the personal interest, which influences the approach to being a correct taxpayer.

Withholding tax enables the government to receive a steady amount of revenue over time, but also at a low cost, as employers and businesses usually pay the tax on a monthly basis and this makes it more likely that they will be able to pay taxes. It also means that fewer people can evade tax intentionally, as the money is taken directly from employees’ salaries or withheld from individuals performing a service, but with as much as 15% of the full payment (gross payment).

Withholding tax can also avoid the tax evasion by nonresidents[1]. Often the withholding tax levels for this category of taxpayers are defined in the double tax treaties between the host country and the country where the individual is registered as a taxpayer, prevailing any norm set in the legislation.

This discussion is mentioned here merely to show the extent of the withholding tax, but is not the subject of analysis, because it applies to a separate treatment and why the beneficial impact of the agreements needs to be known.

The implementation of withholding tax creates opportunities for tax fraud for those individuals who declare annual income and taxes on them, as the legal tax holder may be entitled to a tax refund even if no withholding tax has been withheld. While this is a problem with a very negative history for Value Added Tax (VAT), known as the fraud of the “missing trader” [2], the problem may also arise in the context of withholding tax.

But the advantages that the government has from withholding tax, as an approach to modern tax systems probably does not fit our tax system properly.

The reasons are mostly related to the fact that withholding tax brings some disadvantages for Albanian resident taxpayers. Any money held at source by their payment represents a short-term loss of income, which also represents money they can use during the year to earn some extra money or affect their consumption. Paying tax to the government earlier than individuals declaring annual individual income is in fact a discrepancy in time and equality of treatment between individuals, which needs to be discussed and addressed.

On the other hand, as we all know, the government has the ability not only to spend any revenue collected from taxes, but also to take on debts inside and outside the country by creating large budget deficits (budget gaps). To continue the argument, in the case of unregistered and withholding tax individuals, they do not realize how much revenue goes to the government, and are unlikely to make the connection between their income and the money needed to fund government programs.

Given the fact that the digitalisation of the economy, but also the impacts of the consequences of Covid-19 will change the model of remote service delivery should serve for an open and wide panel of discussions and further and addressing the source tax.

But, beyond the description of the general situation of withholding tax, in this article we will address two topics related to the management of risks that it brings for the future.

The discussion of the first topic is related to the progressiveness of withholding tax for fiscal residents, including NGOs?

Taxation is progressive if, on average, the tax burden increases along with income.

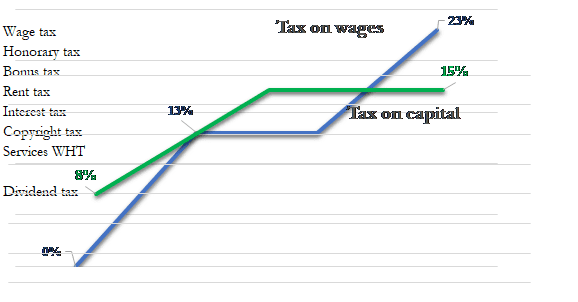

Of course, the updated model of the withholding tax scheme (progressive scheme) could create space for taxpayers to “hide” within the income brackets, but this risk was taken into account when the progressive salary tax scheme was adopted. In the case of salary tax it is a practice that generally extends to individuals receiving middle tax brackets (at 13%). In the case of withholding tax on capital gains (rent, etc.), for income from intellectual property, industrial property, professional services, etc., the tax is at a flat rate of 15% of gross income. In withholding tax, we are dealing with individuals who have nothing to deduct as expenses, but they are deprived of a 15% share of the income they realize for each service they provide, or for each profit from the capital they own.

Then, in the case when a scheme with 15% tax is applied in the same way as the profit tax scheme, it seems that the balances of the taxation of labor and capital are not okay. In most cases, the progressiveness of the individual income tax should be progressive over all sources, because in case work is taxed progressively, while capital and other incomes (not from work as an employee) are taxed at a flat tax rate, then we are in terms of discrimination, which is at least a violation of constitutional rights.

Meanwhile, the actually partial progressive taxation scheme contradicts the principle of taxation of the current government, which has declared before the voters (taxpayers) that whoever earns more pays more and whoever earns less pays less.

In fact, whoever earns more from the relationship as an employee pays more.

But even within this partial progressive taxation scheme there are gaps created due to corruption, evasion based on the informal economy, as well as various updates in the income tax law[3], which have created disproportions of the scheme.

Wealthy individuals, who generally do not generate income from employment, because they earn from capital use are treated with a flat tax rate of 15%. Even in their case, theoretically they should pay a 15% share of gross capital gains.

In everyday reality, the beneficiaries of capital income are not progressively taxed. Even through fiscal policies they are favored in relation to other categories. Thus, the dividend tax was reduced to 8% from the beginning of fiscal year 2019. In an economic environment with notable informality, it remains the task of the government and the initiative of legislators, that this scheme should be adapted, as it cannot work the same as applied in other countries, which have created and maintained an economic environment with less informality and high compliance tax culture with laws.

Arguing the 15% withholding tax rate we think that a flat rate equally for all individuals harms the beneficiaries of small payments the most. Whereas, individuals who benefit from large payments are more insensitive to withholding flat tax rate.

But the same taxation logic should be applied to NGOs.

Although nonprofits are not required by income tax law to pay profit tax, they therefore do not have the same obligation to apply the tax expenses limit known for profit calculation purposes, they are operating in most daily activities of them with individuals performing services for them. Due to the fact that apart from the Accounting Standard for NGOs there are no specific rules, it is timely to include some references in the public discussion of the new law on NGOs, to include the progressive scheme withholding tax for NGOs for the services they pay for. In the case of a specific market such as the case of NGOs, this tax, but also other issues related to them deserve a prominent attention in order to e.g. the withholding tax we are discussing should not be at the rate of 15%, but a lower tax rate, as it has a direct impact on the demand for services and donations.

2. Dividend tax should contribute to the budget

Dividend that is generally related to capital gains, in fact in all these two decades has been an element of capital generation mainly for large foreign and domestic investors, based to tax pressure or stakeholder request. But the real contribution of the dividend tax to the budget is low although it was reduced by 47% below the flat rate of withholding tax.

In the case of dividend tax, the beneficiaries again are not medium-sized businesses, as they do not distribute and pay dividends. Meanwhile, in a market economy dividend distribution is the purpose for which the business operates, as a capital owner does not generate profits other than dividends in a business.

In fact, the law amendment that was made is mostly related to the fact that investors have increasingly used the withholding tax instrument to avoid dividend taxation, adapting in some cases the distribution of dividend on dates after the date of approval of law about the dividend tax.

Dividends and their distribution will be valid at best as the main element of withholding tax, but also as a strong basis for the formalization and genesis of the capital stock.

In a comprehensive reform of the progressive income tax, the government that will come to power after the 2021 elections must, in addition to make that debate as part of the government program, in order to create all the possibilities to achieve its gradual formalization.

This moment of reform is a strong turning point for the modern history of taxation in Albania.

Rule number 1 is that the dividend should be distributed annually, because dividend tax is part of withholding tax.

The withholding tax scheme is not perfect.

As such it currently requires monitoring and for the future perhaps, we can see the changes in the scheme.

In a situation where most businesses face informality on a daily basis, a formal mechanism is needed to address their problem.

In terms of a necessary analysis we think that the main addresses to be studied and discussed would be towards (a) expanding the individual tax base with certain restrictions so as not to increase the cost of administration more than the benefit, or (b) the application of progressive income tax rates, without exception and regardless of whether it is generated by labor or capital.

Maybe why not both of these models together, as together they can work better, both for the state budget, but also for individuals.

[1] foreigners working and earning income in Albania

[2] (Baldwin 2007)

[3] increase of profit tax rate, abolition of simplified profit tax, changes of rules for recognition of tax expenses, etc.

Leave a Reply

You must be logged in to post a comment.