29 countries with the world’s lowest levels of tax

Every year, the World Economic Forum (WEF) releases its Global Competitiveness Report on the state of the world’s economies.

The WEF looks at data on areas as varied as the soundness of banks to the sophistication of businesses in each country. It then uses the data to compile a picture of virtually every country on earth.

One of the indicators the WEF uses is a country’s tax burden, with higher scores indicating lower competitiveness.

To measure tax, it uses the World Bank’s total tax rate. Here’s what goes into that:

The total amount of taxes is the sum of five different types of taxes and contributions payable after accounting for deductions and exemptions: profit or corporate income tax, social contributions, and labour taxes paid by the employer, property taxes, turnover taxes, and other small taxes.

Basically, it’s all the taxes levied on businesses but not those levied on the people who work for them. Business Insider took a look at the countries with the world’s lowest taxes on businesses.

Check them out below:

29. Bulgaria: 27% – Corporate taxes in Bulgaria are just 10%, the same as the maximum possible income tax charged to individuals in the country. That numbers is one of the five lowest in Europe.

28. Thailand: 26.9% – The basic rate of corporate income tax in Thailand is 20%, although profits are taxed differently based on their size. For instance, profits of less than 3 million baht (£60,365) are taxed just 15%.

27. Denmark: 26% – Considering that Denmark has one of the strongest welfare states on earth, the country’s relatively low total rate is pretty surprising.

26. Ireland: 25.9% – Ireland was once home to the famous “double Irish” tax arrangement, pioneered by companies like Apple in the late 1980s to allow them to pay lower corporate tax rates.

25. Laos: 25.8% – Businesses of legal entities based in the southeast Asian state of Laos are charged a 35% rate of tax, while foreign investors are charged just 20% on profits made from business activities done in the country.

24. Botswana: 25.3% – According to the country’s government, Botswana’s basic rate of company tax is 25%. The country operates a progressive tax system.

23. Mauritius: 24.5% – The tiny island nation in the Indian Ocean levies no stamp duty or capital taxes on businesses based in the country.

Getty

22. Mongolia: 24.4% – Basic corporate income tax in Mongolia is 10%, although this jumps to 25% for all profits over 3 billion tugriks (£10.3 million).

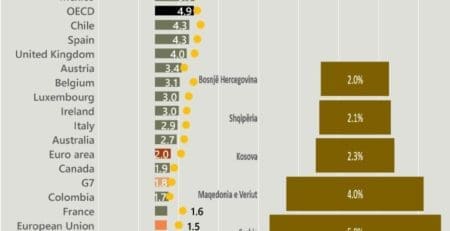

21. Bosnia and Herzegovina: 23.3% – The former Yugoslav state has one of the lowest total rates of tax in Europe, however, a new corporate income tax law will be introduced in the coming months. It has been designed to deal with “deficiencies” in the previous law, so tax rates could go up pretty soon.

20. Cyprus: 23.2% – The island nation in the Mediterranean, frequently subject to land disputes between Turkey and Greece, is considered as something of a tax haven for wealthy Russians.

19. Oman: 23% – The gulf nation, an Islamic sultanate, has an economy that is heavily reliant on oil. The country’s total tax rate is well below the OECD’s 34% median score.

18. Hong Kong: 22.8% – The city has been one of the most attractive places in the world for businesses, with a low-tax environment that goes back to the 1960s.

17. Montenegro: 22.3% – This tiny Balkan state has a corporate income tax rate of just 9% €“ one of Europe’s lowest.

16. Canada: 21% – This is one of the few large, advanced economies that makes it into the upper ranks. The Canadian province Manitoba has a 0% corporation tax rate for small businesses.

15. Cambodia: 21% – The country has attracted a huge amount of foreign investment in the last two decades, and has a much lower Total Tax Rate than most of its developing neighbours.

14. Namibia: 20.7% – Namibia is one of only three African countries that make it onto the list.

13. Armenia: 20.4% – Though Armenia has a fairly simple system, it has been plagued with revenue collection challenges.

12. Luxembourg: 20.2% – Luxembourg came under fire late in 2014 when investigative journalists revealed the extent of the country’s private tax arrangements with major global companies.

11. Croatia: 18.8% – The country both joined the European Union and cut its income taxes during 2013.

10. Singapore: 18.4% – With such low tax rates, many companies from around the world choose Singapore as a base for their Asian operations.

9. Georgia: 16.4% – Since the end of the Soviet Union, Georgia is one of the states that had embraced a low tax model, repeatedly slashing the number of taxes and their rates.

8. United Arab Emirates: 14.8% – Despite its low rate and high ranking, the UAE comes only fourth in the Middle East region, showing how low taxes in that part of the world are.

7. Zambia: 14.8% – The mining hub recently raised royalties on open mines to 20%, before cutting it back to 9% following protests from major commodity companies.

6. Saudi Arabia: 14.5% – The oil giant is able to keep its business taxes extremely low because of its massive petrochemical revenues, though it may suffer if it continues to do so while oil prices are still extremely low.

5. Lesotho: 13.6% – Unlike many of the other countries on the list, Lesotho is one of the poorest in the world, and has the lowest Total Tax Rate of any African country.

4. Bahrain: 13.5% – The country is less oil-rich than some of its neighbours. According to EY, it “levies no taxes on income, capital gains, sales, estates, interest, dividends, royalties, or fees.”

3. Kuwait: 12.8% – The emirate recently rejected an IMF suggestion that it should introduce a business profit tax to address its fiscal shortfall.

2. Qatar: 11.3% – Qatar edges out the region’s other oil-rich states to come in second place, but still loses out to one other nation.

1. Former Yugoslav Republic of Macedonia: 7.4% – As the only country with a tax rate of less than 10% on its businesses, Macedonia has the lowest tax rate on earth. However, the IMF noted in 2015 that public debt has doubled in Macedonia since 2008, partly as a result of this choice.

Leave a Reply

You must be logged in to post a comment.