Government announces 2026 Fiscal Package with major changes, but without consultation

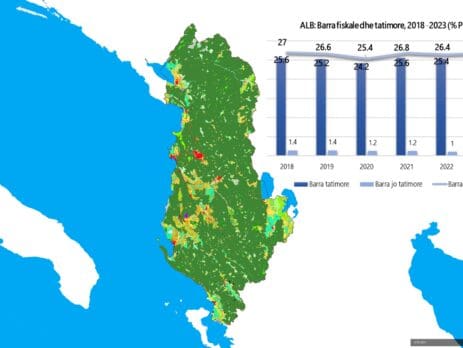

The Albanian government is preparing a new fiscal package set to take effect on January 1, 2026, introducing significant changes to several key laws of the country’s tax and financial system.According to proposals from the Ministry of Finance released to...